Plastic Injection Molding Market Size to Cross USD 17.65 Bn by 2034

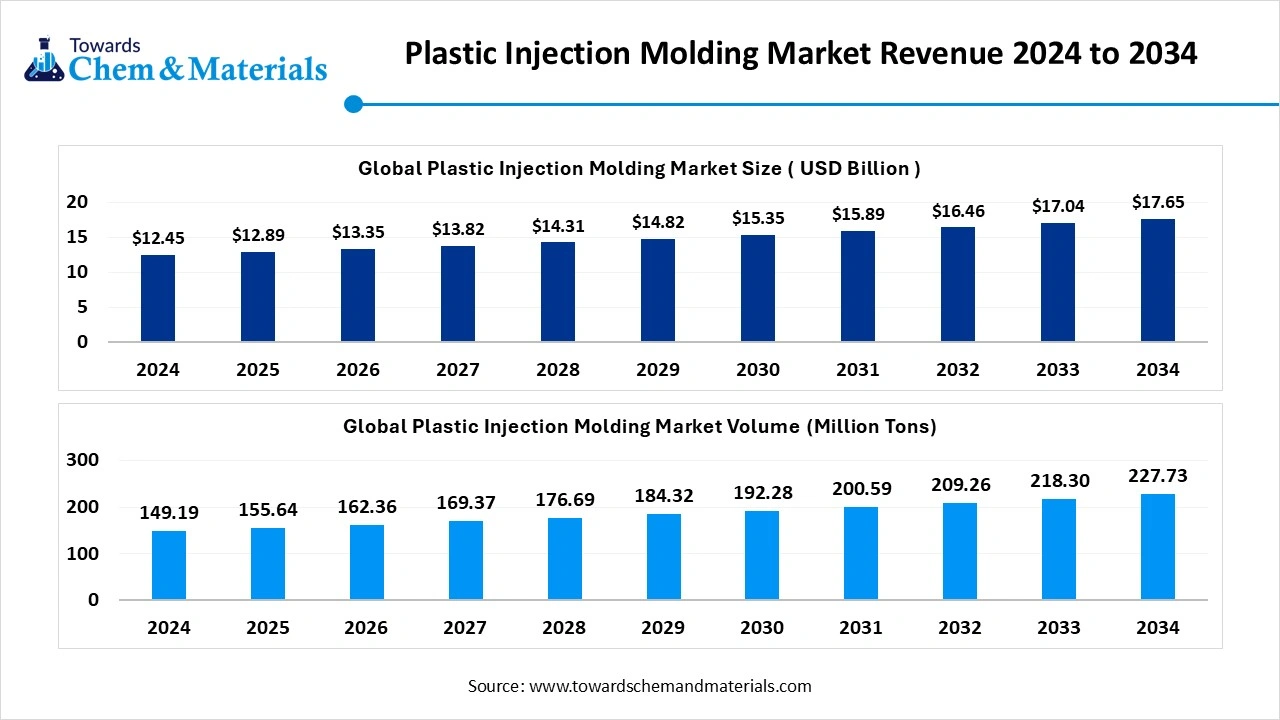

According to Towards Chemical and Materials, the global plastic injection molding market size is calculated at USD 12.89 billion in 2025 and is expected to be worth around USD 17.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

Ottawa, Oct. 13, 2025 (GLOBE NEWSWIRE) -- The global plastic injection molding market size was valued at USD 12.45 billion in 2024 and is anticipated to reach around USD 17.65 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

According to Towards Chemical and Materials, the global plastic injection molding market is experiencing rapid growth, with volumes expected to increase from 155.64 million tons in 2025 to 227.73 million tons by 2034, representing a robust CAGR of 4.32% over the forecast period.

The Rising demand for lightweight, durable and cost-effective plastic components in automotive and consumer electronics is driving the growth of the market.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5838

Plastic Injection Melding Overview

The plastic injection moulding is a crucial segment within the broader plastics industry, widely adopted across sectors such as automotive, electronics, packaging, healthcare, and consumer goods. The process enables efficient mass production of complex plastic parts with high repeatability. Cost effectiveness, and material versatility. Driven by rapid industrialization, rising demand for lightweight components, and growing usage of plastic in daily goods and infrastructure, the injection moulding segment holds a prominent position in the plastics value chain. It is supported by the dominance of petrochemical derived polymers in raw material supply, while demand for sustainable and bio-based polymers is starting to gain traction. Regionally, the Asia Pacific region emerges as a central hub, driven by manufacturing growth, infrastructure expansion, and strong downstream demand in emerging economies. Technological advancements, automation, material innovations, and design optimizations further enhance productivity and open avenues for new applications, reinforcing injection moulding’s role as a backbone of modern plastic manufacturing.

What are the types of mold cavities & plates used in injection molding?

Types of mold cavities

Based on the number of parts that can be produced in the injection mold system, it can be classified as follows:

1. Single cavity injection mold: Single cavity molds produce one part per injection cycle.

- Advantages: It is less expensive and more affordable for low-volume productions. This is because tooling cost for this mold type is lower than other options. It also enables better control of the molding process.

- Disadvantages: It leads to slow production.

2. Multi-cavity injection mold: This allows to create multiple identical parts in one injection cycle.

- Advantages: It is suitable for large-volume productions. The production speed is faster and the cost for a unit part is lower.

- Disadvantages: Initial cost for the injection mold tooling is usually higher than single cavity molds.

3. Family injection mold: This has multiple cavities like the multi-cavity mold.

- Advantages: It usually reduces the overall production cost. It can be used to make several parts in one cycle and save a lot of time and operation cost. This is because one family mold can be useful for various components.

- Disadvantages: It is expensive and a simple multi-cavity mold can only produce one iteration in one cycle. It is only suitable for components made from the same material and color.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5838

Plastic Injection Molding Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 13.35 Billion |

| Revenue forecast in 2034 | USD 17.65 Billion |

| Growth rate | CAGR of 3.55% from 2025 to 2034 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion / Volume and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Raw Material, application, and region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; India; Australia; South Korea; Brazil; Argentina; Saudi Arabia; UAE. |

| Key companies profiled | ALPLA, BERICAP, Berry Global Inc., EVCO Plastics, HTI Plastics, IAC Group, Amcor PLC, AptarGroup Inc. (CSP Technologies), Magna International, Quantum Plastics, Silgan Holdings Inc, The Rodon Group |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

The Top 10 Plastic Injection Molding Materials

1. Acrylic (PMMA)

Acrylic is a strong, clear thermoplastic that provides a lightweight, shatter-resistant alternative to glass. This injection-molded material also offers excellent optical clarity so that a high percentage of light passes through. Acrylic resists ultraviolet (UV) light and weather, and is also known as PMMA, or by its full chemical name: poly (methyl methacrylate).

Properties

Unlike some plastics, acrylic can withstand exposure to water and hold tight tolerances. PMMA won’t absorb odors, but it cannot resist solvents and is easily stained by greases and oils. Although injection-molded acrylic has high tensile strength, it’s prone to stress cracking under heavy loads.

Applications

Applications for acrylic injection molding include windows, greenhouses, solar panels, bathroom enclosures, and other transparent components for architectural, lighting, and outdoor applications.

Grades and Brands

General-purpose and specialty grades of PMMA plastics are available, including:

- General-purpose acrylic is used in commodity products.

- Sign-grade acrylic is stronger and provides excellent light transmission for outdoor signage.

-

Marine-grade acrylic resists continuous exposure to water.

Common brand names for acrylic plastics include Trinseo PLEXIGLAS®, which is available with high heat resistance, and DuPont LUCITE®, which has excellent optical clarity and transparency.

2. Acrylonitrile Butadiene Styrene (ABS)

ABS has a relatively low melting point that makes it easy to mold. This opaque polymer supports the use of colorants as well as various textures and surface finishes. Its butadiene content delivers exceptional toughness, even at low temperatures, and its styrene content imparts a shiny, attractive finish to plastic injection molded parts.

Properties

ABS is known for its strength and impact resistance, but it lacks strong resistance to sunlight (UV), water, and weather. Compared to acrylic, injection-molded ABS is not a good choice for outdoor applications. ABS also generates significant smoke when burned and, unlike nylon, provides poor resistance to high friction.

Applications

ABS injection molding is used to produce many types of plastic parts, including:

- keyboard keys

- protective headgear

- electrical outlet wall plates

- automotive parts like wheel covers

- consumer goods

- sports equipment

- industrial fittings

Grades and Brands

Well-known brands of ABS include Samsung Starex, Toray Toyolac, BASF Terluran, and Ineos Lustran.

3. Nylon Polyamide (PA)

Nylon is a synthetic polyamide (PA) that combines toughness and high heat resistance with high abrasion resistance, good fatigue resistance, and noise-dampening properties. Nylon isn’t inherently flame-resistant, but flame-retardant versions are available. Similarly, although nylon can be degraded by sunlight, a UV stabilizer can be added to improve outdoor performance.

Properties

Compared to other plastics, nylon provides poor resistance to strong acids and bases. Nylon is not as strong as polypropylene and can’t match polycarbonate for impact resistance. Injection molding nylon is challenging because it’s prone to shrinkage and is subject to inadequate mold filling.

Applications

Applications for nylon injection molding include:

- strong mechanical parts such as bearings, bushings, gears, and slides

- casings and snap-fit closures

- threaded inserts and kinetic parts

- jigs and fixtures

With its low coefficient of friction, nylon is also well-suited for applications with high-friction and wear.

Grades and Brands

Nylon comes in four main grades, and each has slightly different mechanical properties:

- Nylon 11 is used in outdoor applications and has greater resistance to dimensional changes.

- Nylon 12 has the lowest melting point of all four grades and resists water absorption.

- Nylon 46 has the highest operating temperature.

- Nylon 66 has a high melting point and resists acids used in chemical processing.

4. Polycarbonate (PC)

Polycarbonate is strong, lightweight, and naturally transparent. This plastic injection molding material has excellent optical properties to support light transmission, but maintains its color and retains its strength when pigmented. Although it isn’t scratch-resistant, polycarbonate is significantly stronger than glass and is extremely durable.

Properties

Injection-molded polycarbonate is sometimes used instead of acrylic because PC maintains its physical properties over a wider temperature range. PC requires high processing temperatures, however, which can make it more expensive to mold. With its predictable and uniform shrinkage, however, polycarbonate offers precise dimensional control for tighter tolerances.

Applications

Applications for polycarbonate injection molding include:

- machinery guards

- clear and tinted windows

- diffusers and light pipes for light-emitting diodes (LEDs)

- clear molds for urethane and silicone casting

Because it contains the chemical bisphenol A (BPA), polycarbonate is not recommended for food preparation or storage.

Grades and Brands

Polycarbonate plastic can be filled with glass and is available in grades that contain a relatively small percentage of stainless steel fiber. Popular brands include SABIC Lexan®, which is available in flame-resistant versions, and Covestro Makrolon®, which has glass-like transparency.

5. Polyethylene (PE)

Polyethylene is the most commonly used plastic in the world and is a commercial polymer that can be selected according to its density. High-density polyethylene (HDPE) and low-density polyethylene (LDPE) both provide chemical resistance, but they differ in terms of their hardness, flexibility, melting point, and optical transparency.

Properties

PE plastics include polyethylene terephthalate (PET, PETE), a material that is not defined by its density. Like LDPE, PET can be as clear as glass; however, designers can also select grades of PET or PETE with different levels of optical clarity. HDPE, LDPE, and PET all resist moisture and chemicals, but LDPE is softer and more flexible than HDPE, which is an opaque material.

Applications

Applications for polyethylene injection molding may be limited to indoor applications because of their poor UV resistance. Because they are unable to withstand high service temperatures, these plastic materials may not be suitable for some processing applications. Often, injection molded polyethylene is used in products such as housewares, toys, food containers, and automotive parts.

Grades and Brands

PE plastics come in numbered grades where higher numbers generally indicate higher densities. For example, HDPE 500 has a higher density than HDPE 300. Both grades have a higher density than LDPE, which also uses a numbering system for grades. BASF and DuPont are two of the leading suppliers of PE for engineering (as opposed to general-purpose) applications.

6 . Polyoxymethylene (POM)

Polyoxymethylene (POM) is an engineering plastic that is also known as acetal. It combines excellent rigidity with thermal stability and has a low coefficient of friction. This plastic material has low water absorption and good chemical resistance. In terms of appearance, POM plastics are naturally opaque and white in color.

Properties

In its pure form, acetals have low impact strength and a very high rate of thermal expansion. Yet, POM can be reinforced with fiberglass or minerals for improved strength and stiffness. Compounds that are reinforced with both provide an excellent balance of mechanical properties. Because injected molded POM lacks resistance to sunlight, its outdoor applications are limited.

Applications

With its low coefficient of friction, injection-molded POM is used in bearings, gears, conveyor belts, and pulley wheels. Additional applications include fasteners, eyeglass frames, parts for knives and firearms, lock systems, and high-performance engineering components.

Grades and Brands

There are two main types of acetal plastics: homopolymers, which provide higher hardness and tensile strength, and POM copolymers. Neither type of material can be fire-rated to a standard such as UL 94, and both experience relatively high shrinkage during injection molding. Popular brand names for POM plastics include DuPont Delrin® and Ensinger TECAFORM®.

7 .Polypropylene (PP)

Polypropylene is the second most commonly used plastic in the world. It provides good chemical resistance, retains its shape after torsion or bending, has a high melting point, and won’t degrade when exposed to moisture or water. Injected molded polypro, as PP is sometimes called, is also recyclable.

Properties

Despite its comparative advantages, polypropylene degrades with UV light and is extremely flammable. At temperatures above 100° C (212° F), this injection-molded plastic dissolves into aromatic hydrocarbons, such as benzene and toluene, which are harmful to humans. Polypropylene plastic is also difficult to bond and paint.

Applications

Applications for polypropylene injection molding include

- toys

- storage containers

- sporting goods

- packaging

- appliances

- power tool bodies

Grades and Brands

Pure polypropylene is a commodity plastic with the lowest density, but high crystalline polypropylene (HcPP) is filled with glass fibers for rigidity. Semitron® from Mitsubishi Chemical Advanced Materials is a leading brand.

8 . Polystyrene (PS)

Polystyrene plastics are lightweight, relatively inexpensive, and resistant to moisture and bacterial growth. These commodity plastics also provide good chemical resistance to diluted acids and bases and have excellent resistance to gamma radiation, which is used to sterilize medical devices.

Properties

There are two main types of polystyrene: general-purpose polystyrene (GPPS) and high-impact polystyrene (HIPS). GPPS is brittle and has less dimensional stability than HIPS, which is compounded with butadiene rubber to enhance its material properties. GPPS also has a glass-like clarity whereas HIPS is opaque.

Applications

Applications for polystyrene injection molding include medical, optical, electrical, and electronic applications. With its higher impact strength, HIPS is often used with appliances and equipment, while injection-molded GPPS is used in plastic toys, cases, containers, and trays.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5838

Here Are Some Of The Top Products In The Plastic Injection Molding Market

- Bottle Caps & Closures – Used in beverage, food, and pharmaceutical packaging (e.g., by BERICAP, Berry Global).

- Automotive Interior Parts – Dashboards, door panels, and consoles (e.g., by IAC Group, Magna International).

- Medical Device Housings – Casings for inhalers, diagnostic tools, and syringes (e.g., HTI Plastics, AptarGroup).

- Food Containers – Reusable and single-use tubs, trays, and lids (e.g., Amcor, Berry Global).

- Dispensing Pumps & Valves – Used in personal care and household products (e.g., AptarGroup).

- Electronic Housings – Casings for devices like remote controls and routers (e.g., Quantum Plastics).

- Closures with Tamper Evident Seals – Ensuring product integrity in pharmaceuticals and beverages.

- Cosmetic Packaging – Compacts, jars, and lip balm containers (e.g., ALPLA, Berry Global).

- Industrial Components – Gears, brackets, and custom enclosures (e.g., EVCO Plastics).

- Child-Resistant Packaging – Used for pharmaceuticals and chemicals (e.g., CSP Technologies under AptarGroup).

What Are The Major Trends In The Plastic Injection Molding?

- Growing focus on sustainability through increased use of recycled content and bio based polymers in molded plastics.

- Rising adoption of full electric and energy efficient injection molding machines to reduce power consumption and improve operational cost effectiveness.

- Integration of AI, IoT, and real time monitoring systems for process optimization, predictive maintenance, and quality control.

- Increasing demand for lightweight materials specially in automotive and electric vehicle sectors to enhance fuel/ electric efficiency.

- Escalating regulatory and consumer pressure toward recyclable, less wasteful packaging and elimination of single use plastics, pushing innovation in designs and material choices.

Plastic Injection Molding Market Dynamics

Growth Factors

Can Smarter Quality Control Reduce Waste And Boost Profits?

By embedding AI powered vision systems and analytics into injection molding lines, manufacturers can detect microscopic defects in real time, catch anomalies before they propagate, and dynamically adjust process settings to preserve quality. This drives up yield, cuts scrap, and enhances customer trust.

Will Energy Wise Machines Become The Norm In Molding?

As energy costs and environmental pressure rise, injection moulders are shifting toward all electric and servo driven machines that operate more efficiently, consume less power, and reduce waste heat and hydraulic losses. This supports both sustainability goals and lower operational expenditure.

Market Opportunity

Could Custom On-Demand Molding Open New Client Avenues?

As more companies look to outsource and scale production flexibility, injection molars who offer low volume, fast turnaround, bespoke services stand to attract start-ups, niche brands, and prototyping firms. This opens pathways into markets that historically avoided long lead times and large minimum orders. The modular nature of modern molding setups enables scaling up with demand while preserving responsiveness.

Will Advanced Parts For Medical And Telecom Drive New Demand?

The growth of medical devices, wearable sensors and telecom equipment is pushing demand for high precision, small and multifunctional plastic parts, creating openings for injection moulders who specialize in these domains. Techniques such as molded interconnected device (MID) allow embedding circuitry directly into molded plastics, which is ideal for compact electronics and miniaturized devices.

Limitations In The Plastic Injection Molding Market

- High cost of raw materials and energy inputs creates pressure on margins, making production expensive and affecting competitiveness.

- Strict environmental regulations and increasing demand for sustainable alternatives force manufacturers to adapt, often entailing additional investment in cleaner technologies and processes.

Plastic Injection Molding Market Segmentation Insights

Raw Material Insights

Why Is Polyethylene Segment Dominating in Plastic Injection Melding Market?

The polyethylene segment dominated the market in 2024, driven by its versatility, cost effectiveness, and durability. Polyethylene is widely used across heavy industries, packaging, and construction due to flexibility, lightweight, properties, and ease of molding. Manufacturers rely on to for producing a wide range of components, from consumer goods to industrial containers, making it indispensable for mass production. Its compatibility with recycling processes and its ability to meet stringent safety and quality standards have further solidified its dominance in the market.

The polypropylene segment is projected to expand rapidly in the market during the forecast period, in the coming years as industries increasingly recognize its strength, heat resistance, and adaptability. Its superior performance under mechanical stress and chemical exposure makes it ideal for automotive parts, medical devices, and packaging solutions. The growing emphasis on lightweight and sustainability aligns well with polypropylene’s recyclability and low environmental impact. As manufacturers innovate with new polymer blends and molding techniques, polypropylene continues to gain traction as a high performance material shaping the future of plastic injection molding.

Application Insights

Why Is Packaging Segment Dominating in Plastic Injection Molding Market?

The packaging segment dominated the market in 2024, driven by the growing demand for lightweight, durable, and cost-effective packaging solutions across various industries. Plastics offer versatility in design, ease of mass production, and the ability to meet stringent food safety standards, making them ideal for packaging applications. The rise of e-commerce and consumer preference for convenient, ready to use products further fuelled the need for efficient packaging solutions. Additionally, advancements in molding technologies have enabled the production of complex packaging designs, enhancing product appeal and functionality. As sustainability becomes a priority, the industry is also exploring recyclable and biodegradable materials to align with environmental goals.

The automotive and transport segment is set to experience the fastest rate of plastic injection molding market growth from 2025 to 2034, driven by the increasing demand for lightweight materials that enhance fuel efficiency and reduce emissions. The automotive industry is adopting injection moulded plastic components for various applications, including interior parts bumpers and engine components, due to their strength, durability, and cost effectiveness. Moreover, the rise of electric vehicles (EVs) has further accelerated the adoption of plastic components, as manufacturers seek to reduce vehicle weight and improve energy efficiency. Technological advancements in molding processes have also enabled the production of complex and high precision parts, meeting the stringent requirements of the automotive sector.

Regional Insights

How Is Asia Pacific Dominating The Plastic Injection Molding Market?

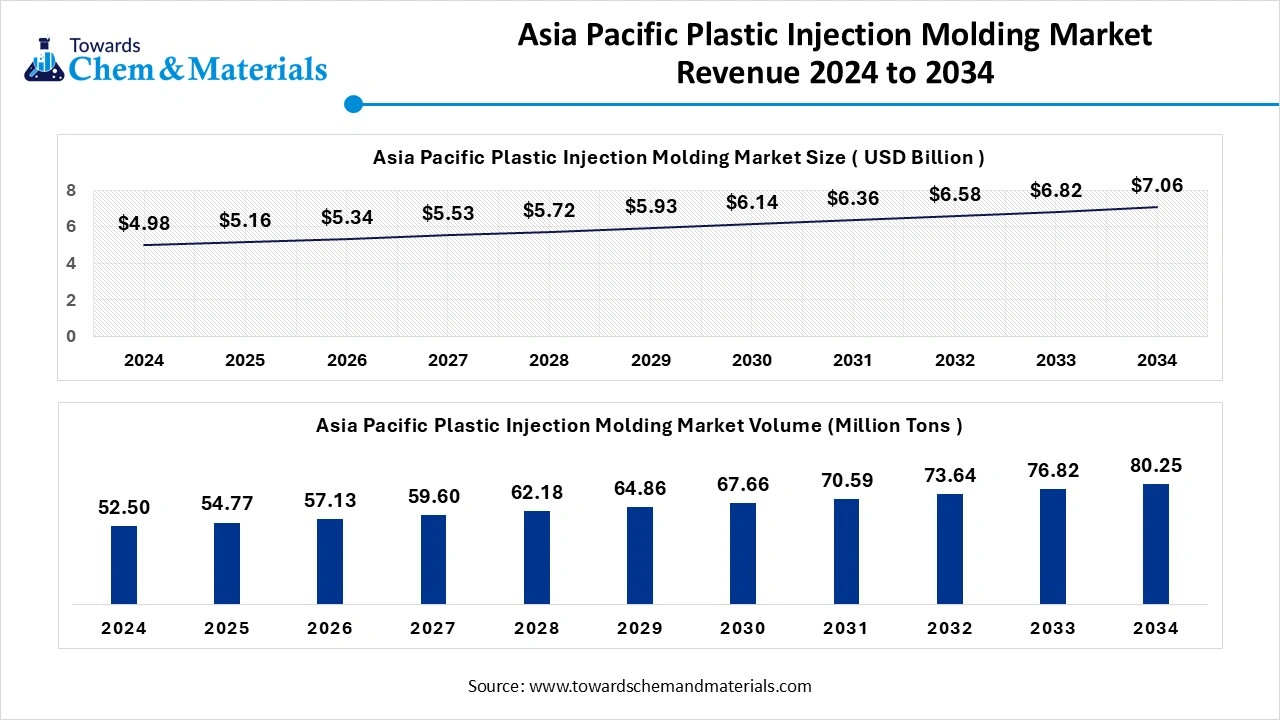

The Asia Pacific plastic injection molding market volume is expected to produce approximately 54.77 million tons in 2025, with a forecasted increase to 80.25 million tons by 2034, growing at a CAGR of 4.34% from 2025 to 2034.

The asia pacific plastic injection molding market size was estimated at USD 4.98 billion in 2024 and is projected to reach USD 7.06 billion by 2034, growing at a CAGR of 6.82% from 2025 to 2034. The Asia Pacific dominated the plastic injection molding market in 2024.

Asia Pacific dominated the market in 2024. Demand for plastic components in sectors like packaging, electronics, automotive, and construction is especially high in countries such as China, India, Japan, and Southeast Asia. Government support, low-cost labour, and expanding supply chains further enhance its competitiveness and appeal for global plastic manufacturers. Also, growing awareness around recycling and regulations are pushing manufacturers in Asia Pacific to adopt sustainable materials and processes, reinforcing its leading position.

China maintains a critical role because of its massive industrial base, high local demand across many end-use sectors, and strong investments in both production capabilities and innovation. India is emerging rapidly thanks to urbanization, growing domestic consumption, and favourable policies that support manufacturing and exports. The combination of these two countries growth, especially in automotive, packaging, consumer electronics, and infrastructure, drives regional trends and shapes supply chain decisions for many global players.

What Makes Europe The Fastest Growing Regions?

Europe segment is projected to experience the highest growth rate in the plastic injection molding market between 2025 and 2034. Governments are pushing for circular economy frameworks, promoting bio-based and biodegradable polymers, and supporting chemical recycling products that align with sustainability goals, which encourages innovation in polymers and molding technologies. All this is fuelling expansion, especially in regions in Eastern Europe where infrastructure is catching is and demand for recycled content in packaging, automotive, and textiles is rising sharply.

Plastic Injection Molding Market Top Companies

- ALPLA – Specializes in custom injection-molded plastic packaging for food, beverages, and personal care.

- BERICAP – Produces injection-molded caps and closures for various industries, enhancing product safety and sustainability.

- Berry Global Inc. – A global leader in injection-molded plastic packaging for healthcare, hygiene, and consumer products.

- EVCO Plastics – Offers precision custom injection molding for medical, automotive, and industrial sectors.

- HTI Plastics – Provides high-volume injection molding for medical devices and consumer goods.

- IAC Group – Supplies injection-molded interior automotive components.

- Amcor PLC – Utilizes injection molding in rigid packaging for food and healthcare.

- AptarGroup Inc. – Innovates injection-molded dispensing solutions via CSP Technologies.

- Magna International – Manufactures injection-molded automotive parts and assemblies.

- Quantum Plastics – Delivers custom injection molding across diverse industries including electronics and consumer goods.

More Insights in Towards Chemical and Materials:

- Plastic Compounding Market ; The global plastic compounding market size was reached at USD 72.55 billion in 2024 and is expected to be worth around USD 148.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

- Plastics Market : The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- Biodegradable Plastics Market : The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034.

- Microplastic Recycling Market : The global microplastic recycling market size was reached at USD 325.19 million in 2024 and is expected to be worth around USD 817.00 million by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period 2025 to 2034.

- Mechanical Recycling of Plastics Market ; The global mechanical recycling of plastics market size was reached at USD 37.85 billion in 2024 and is expected to be worth around USD 92.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.39% over the forecast period 2025 to 2034.

- Recycled Plastic Pipes Market : The global recycled plastic pipes market size was approximately USD 7.85 billion in 2024 and is projected to reach around USD 20.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.85% between 2025 and 2034.

- Carbon Fiber Reinforced Plastic (CFRP) Market : The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034

- Plastic Hot and Cold Pipe Market : The global plastic hot and cold pipe-market size was valued at USD 7.85 billion in 2024, grew to USD 8.37 billion in 2025, and is expected to hit around USD 14.93 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.64% over the forecast period from 2025 to 2034.

- Commodity Plastics Market : The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- Corrugated Plastic Sheets Market : The global corrugated plastic sheets market size was valued at USD 1.85 billion in 2024, grew to USD 1.95 billion in 2025, and is expected to hit around USD 3.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.14% over the forecast period from 2025 to 2034.

- U.S. Plastics Market : The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

- Plastic Lidding Films Market : The global plastic lidding films market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.42% over the forecast period 2025 to 2034.

- Sustainable Plastics Market ; The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Circular Plastics Market : The global circular plastics market size was reached at USD 73.19 billion in 2024 and is expected to be worth around USD 182.21 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.55% over the forecast period 2025 to 2034.

- Recycled Plastics In Green Building Materials Market : The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034.

Plastic Injection Molding Market Top Key Companies:

- ALPLA

- BERICAP

- Berry Global Inc.

- EVCO Plastics

- HTI Plastics

- IAC Group

- Amcor PLC

- AptarGroup Inc. (CSP Technologies)

- Magna International

- Quantum Plastics

- Silgan Holdings Inc

- The Rodon Group

Recent Developments

- In February 2025, Hillenbrand Inc. announced the sale of a 51% stake in its Milacron division to an affiliate of Bain Capital Situations for $287 million. This move allows Hillenbrand to reduce its debt while retaining a significant interest in the injection molding and extrusion business. The traction is expected to close by the beginning of Hillenbrand’s fiscal third quarter.

- In April 2025, in a significant move within the plastics industry, Amcor, an Australian packaging giant, announced its acquisition of Berry Global Group. This merger positions. Amcor as the world’s largest plastic packaging company, consolidating its presence in North America, Western Europe, and emerging markets. Despite initial market scepticism due to Amcor’s existing net debt, analysts view the merger as a strategic step to achieve cost synergies and enhanced market reach.

Plastic Injection Molding Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Plastic Injection Molding Market

By Raw Material

- Polypropylene

- Acrylonitrile Butadiene Styrene (ABS)

- Polystyrene

- Polyethylene

- Polyvinyl Chloride (PVC)

- Polycarbonate

- Polyamide

- AcrylonitrileButadieneStyrene

- High Density Polyethylene

- Other Raw Materials

By Application

- Packaging

- Building and Construction

- Consumer Goods

- Electronics

- Automotive and Transportation

- Healthcare

- Other Applications

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5838

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.